The basis of Trade Nexus 9.3 GPT's operations is advanced algorithms and machine learning techniques. Combining these technologies, the app scans thousands of data from the stock and crypto markets daily. This allows users of Trade Nexus 9.3 GPT to receive timely updates and insights that reflect current market conditions.

Additionally, the data-based platform has a user-friendly interface. The app was designed to be accessible to every form of trader and investor seeking market insights. With tools such as personalized AI assistance and real-time analytics, Trade Nexus 9.3 GPT builds a conducive environment for users

Every user of the Trade Nexus 9.3 GPT app gets an artificial assistant. The job of this assistant is to provide timely advice based on the user's preferences and risk tolerance. By analyzing your trading patterns and the market trend, the AI assistant recommends investment strategies.

This is a standout feature in a volatile stock market. Users of Trade Nexus 9.3 GPT have immediate access to market data and trends.

With the Trade Nexus 9.3 GPT analytics tool in place, investors can monitor stock performance and market fluctuations. It's also applicable to the crypto market.

Trade Nexus 9.3 GPT features a user-friendly interface designed to simplify investment analysis. Users can easily navigate the app to access data and tools.

This accessibility ensures that novice and experienced investors can utilize the Trade Nexus 9.3 GPT app effectively. Therefore, their overall experience is enhanced without complexity.

App users can assess stocks and crypto investments easily with AI-driven insights. This way, users streamline their investment process and build trading strategies.

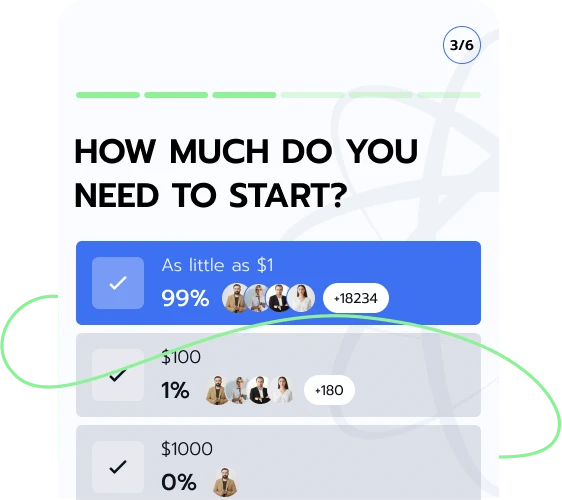

Financial investments could either end positively or negatively. The Trade Nexus 9.3 GPT app features a calculator that helps evaluate your potential return based on various investment scenarios.

The investment diary tool makes financial tracking easier. Applying it, users can monitor expenses and income. This helps to understand your financial situation and progress better.

By delivering concise and relevant market updates, Trade Nexus 9.3 GPT helps users identify potential investment opportunities and risks. With constant updates, the app's users can adjust their strategies accordingly. This ensures they remain competitive in the fast-paced world of stocks and cryptocurrencies.

The stock market is regarded as the heart of modern finance. The foundation of many economies is based on stock trading. What is the stock market? In short, it is a network of trading operations. Here, companies’ shares are bought and sold. In this section, we will discuss market operations.

Think of a stock exchange as a marketplace. In this market, companies list their shares, and investors buy them. Other things in the marketplace include bonds, ETFs, and more. Trading platforms bring these exchanges to an investor's doorstep. They provide the tools for users to execute trades and build their portfolios

Various participants contribute to stock market operations. This includes individual investors, institutional investors, and market makers. Each participant employs unique strategies that influence market dynamics. Their actions collectively affect stock prices and overall market trends. All together, they create a complex environment where informed decision-making is essential for investing.

Individual Investors in the Market

These investors buy and sell stocks based on personal strategies and risk preferences.

Institutional Investors in the Market

Institutional investors manage large funds. They influence markets with strategic, long-term investments and risk management.

Role of Stock Market Markers

Market makers provide liquidity. With this, they ensure smooth trading by continuously buying and selling stocks.

Putting the roles of each market participant together, they form the backbone of financial markets. Their contributions are towards price discovery, liquidity, and overall market functioning. Without these financial participants, the stock market ecosystem will cease to exist.

Government or regulatory bodies oversee stock market operations. The laws put out by these bodies are to ensure fair practices. Investment laws also cover transparency and investor protection. Companies with listed shares must adhere to strict reporting standards. On the other hand, investors and brokers follow rules designed to maintain market integrity. Note that the regulation is based on jurisdiction.

Governments and corporations issue bonds to raise money. Investors may then be paid back with periodic interest payments. Also, the principal is returned at maturity. Options grant owners the right to buy or sell at the exercise price. However, the owner is not obligated to exercise (buy or sell) the option. ETFs are funds traded on exchanges, typically tracking a specific index. ETFs offer diverse assets that are tradable during market hours, reducing risk.

Secondary market investors may benefit from liquidity and changes. They adjust strategies by trading based on market conditions. Like any financial instrument, they are associated with risks. It's essential to research before investing. Balancing the reward and risk ratio may help in meeting your investment objectives.

Since entering the market, cryptocurrencies have become a global phenomenon. Bitcoin was the first to launch. It introduced people to the endless possibilities of blockchain technology. Other projects follow suit. Today, there are thousands of crypto assets. Utilizing blockchain technology, they each offer unique features. Now, millions of people around the world actively trade these digital assets

The crypto market is volatile. Due to how fast prices can change, it has caught the eyes of several governments. Several laws are now in place to regulate crypto assets trading. These regulations in place might make it an unattractive option to certain investors.

Bitcoin was launched in 2009. Its creation marked a new era for modern finance. The digital asset is currently valued at over $500 billion. There are several ways to trade BTC besides being a crypto token. They include the integration of ETFs and futures contracts.

Altcoins refer to cryptocurrencies other than Bitcoin. There are thousands of altcoins. However, the most popular is Ethereum (ETH). Most altcoins were created to solve BTC limitations. For example, LTC was created to be a light version of BTC. Transactions are, therefore, faster.

As stated earlier, the crypto market is volatile. Stablecoins were created to ensure there could be a haven when trading. These tokens were designed to maintain a stable value. How? They are pegged to fiat currencies such as the US dollar.

The name suggests what these tokens entail. Memecoins are mostly inspired by internet memes. Other times, they are based on pop culture trends. They are the most unstable type of cryptocurrency. Most meme coins follow the “pump and dump” mechanism. Examples of these tokens are Dogecoin and Shiba Inu.

Cryptocurrencies rely solely on market behavior. This is the major reason for their volatility. The effect of an unstable market leads to the potential for short-term trading. Therefore, there is a divergence in risk and reward. It is a suitable investment vehicle to try for quick returns.

Popular investment alternatives include real estate, precious metals, and art. Over the years, these niche markets have grown. This makes them suitable options.

Firstly, real estate involves rental income and long-term appreciation potential. Secondly, precious metals may have value preservation during economic uncertainty periods. Lastly, the art industry appeals to collectors and investors due to its stability and possible tax breaks.

Although both terms are somewhat similar, they operate differently based on a timed structure. Investment involves buying assets for possible long-term growth and income. In contrast, trading targets short-term gains through frequent buying and selling. Investments are often made based on fundamental analysis and market trends, while traders rely on technical analysis and market timing.

Liquidation occurs when the margin falls below the required level. It leads to a forced sale of the asset.

Fluctuations occur from factors such as economic and geopolitical issues. It then reflects on market sentiment, which could negatively affect the overall market value.

This is particularly common in cryptocurrency investments. Price swings occur rapidly, which may result in financial losses.

If the single asset portfolio fails to perform, there would be a significant negative impact on the investor’s capital.

During such times, purchasing power erodes. This can negatively impact both individual investments and overall market performance. It also affects interest rates.

At one point, the company may decide to reduce or eliminate dividends. This would affect the income of investors relying on these payments.

The top features available at Trade Nexus 9.3 GPT include a personalized AI assistant and an investment calculator. Download Stocks Synergy AI today and start seeing your portfolio in a new light!

| 🤖 Initial Cost | Registration is without cost |

| 💰 Fee Policy | Zero fees applied |

| 📋 How to Register | Quick, no-hassle signup |

| 📊 Educational Scope | Offerings include Cryptocurrency, Forex, and Funds management |

| 🌎 Countries Serviced | Operates globally except in the USA |